Helpful Guides

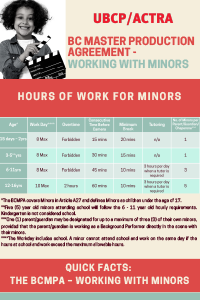

BCMPA Working with Minors

A quick fact guide to select articles related to minors from the British Columbia Master Production Agreement.

Stage Parent Survival Guide (ACTRA)

The Stage Parent Survival Guide is an invaluable resource for parents and guardians of school-aged children in the Canadian film and TV industry.

Public Guardian and Trustee (PGT) FAQ's

A curated list of most frequently asked questions about the PGT.

BCMPA Working with Infants

A quick fact guide to select articles related to infants from the British Columbia Master Production Agreement.

Campaigns

Protect Child Performers’ Income

ISSUE: In the late 1990s, the provincial government implemented a regulation that requires producers to save a portion of child performers’ earnings to the Public Guardian and Trustee (PGT). Since that time, parents and guardians across BC have lost confidence in the PGT and share concerns regarding the high fees that are charged, the lack of transparency and issues with communications.

ISSUE: In the late 1990s, the provincial government implemented a regulation that requires producers to save a portion of child performers’ earnings to the Public Guardian and Trustee (PGT). Since that time, parents and guardians across BC have lost confidence in the PGT and share concerns regarding the high fees that are charged, the lack of transparency and issues with communications.

PLAN: UBCP/ACTRA is calling on the provincial government to amend the Employment Standards Regulation so that child performers and their guardians can have their income protected by ACTRA PRS Minors’ Trust, which has been protecting child performers’ earnings in the rest of Canada since 1999.

TAKE ACTION: Write a letter to the Minister of Labour showing your support of UBCP/ACTRA’s call to allow child performers to better protect their earnings by keeping them with ACTRA PRS’ Minors’ Trust

The BC Public Guardian and Trustee In the late 1990s, the provincial government implemented a regulation that requires producers to save a portion of child performers’ earnings to the Public Guardian and Trustee (PGT). The PGT is an organization that protects the interests of British Columbians who lack legal capacity to protect their own interests. This includes protecting the legal and financial interests of children under the age of 19 years, adults who require assistance in decision making, and deceased and missing persons. The PGT charges an income commission of 3.94% on each deposit a producer makes on a child performer’s behalf into their trust, and a further 3.94% on any income earned on it. An additional 0.74% is charged per year – and compounded monthly – on the total value of all the child performer’s assets. This can often mean that a child performer’s account balance with the PGT is less than what was contributed over the life of their career. The ACTRA PRS Minors’ Trust By contrast, the ACTRA PRS Minors’ Trust charges 2.26% of income commission, and yields a much better return than the PGT. The Minors’ Trust is also more transparent and listens to child performers and their guardians. That’s because PRS was created by ACTRA and mandated to specifically to protect child performers’ earnings.

| BC PGT | ACTRA PRS Minors’ Trust | |

| Fees on Contributions | 3.94% | 2.26% |

| Fees on Income Earned | 3.94% | 0% |

| Fees on Gross Assets | 0.74% per year | 0% |

| Return | 1.97% | 4.35% |

We want child performers to enjoy the benefits of the ACTRA PRS Minors’ Trust.

The PRS provides:

- Better financial management – to protect our minor members’ earnings

- Better communication – ACTRA PRS staff respond to questions and work to resolve issues brought forward by members

- Compliance – Our union reps have direct communication with the ACTRA PRS Minors’ Trust and access to all information needed to investigate discrepancies and ensure producers are remitting child performers’ earnings in accordance with the law.

Outside of BC any child performers’ earnings are held with the ACTRA PRS Minors’ Trust. In BC any child performer earnings must go to the PGT, meaning that any child performers’ working in BC will have to have more than one trust account.

UBCP/ACTRA recently conducted a survey to child performers and their guardians.

Key findings:

- More than three quarters (78.85%) of survey participants are unsatisfied or very unsatisfied with the financial management of their or their child’s PGT account, citing high fees as their primary concern

- No one who has experienced both trust administrators would choose to keep their or their children’s money with the PGT

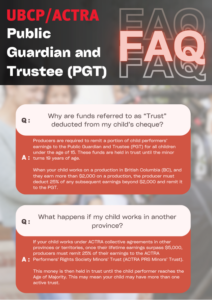

FAQ: Trust deductions for Minors working in BC.

Producers are required to remit a portion of child performers’ earnings to the Public Guardian and Trustee (PGT) for all children under the age of 15. These funds are held in trust until the minor turns 19 years of age.

When your child works on a production in British Columbia (BC), and they earn more than $2,000 on a production, the producer must deduct 25% of any subsequent earnings beyond $2,000 and remit it to the PGT.

If your child works under ACTRA collective agreements in other provinces or territories, once their lifetime earnings surpass $5,000, producers must remit 25% of their earnings to the ACTRA Performers’ Rights Society Minors’ Trust (ACTRA PRS Minors’ Trust). This money is then held in trust until the child performer reaches the Age of Majority. This may mean your child may have more than one active trust.

The PGT issues a statement when funds are first received and then only issues a statement quarterly if there was a deposit to the account within the 3-month period before statements are issued. You should also receive a statement when your child reaches 17, and again before they turn 19.

The PGT has stated on their website that you can request additional statements by contacting [email protected]

As your union, we can get in touch with the producer to ensure that everything was remitted correctly, and verify that your child’s cheques have been cashed by the PGT. If we find that the funds have likely been managed incorrectly by the PGT, we are limited in how we can asist you.

If the PGT’s response is inadequate, we recommend making complaints to the BC Ombudsperson and/or your MLA.

The PGT charges higher fees than the ACTRA PRS Minors’ Trust, and these fees are also subject to taxes. The BC PGT holds trusts in two different investment funds, and interest rates vary from year to year. The decision of which fund your child’s trust is held in is based on factors including your child’s age, the amount of money in their trust account and the investment horizon.

Here is a breakdown of the fees:

| BC PGT | ACTRA PRS Minors’ Trust | |

| Fees on Contributions | 3.94% | 2.26% |

| Fees on Income Earned | 3.94% | 0% |

| Fees on Gross Assets | 0.74% per year | 0% |

| Return | 1.97% | 4.35% |

The Premium Money Market Fund is lower risk and lower return. Accounts with less than $25,000 held in trust will be in this fund. Should your child’s trust fund pass the $25,000 threshold, then any additional funds will be placed in the Balanced Growth Fund.

If you have additional questions about these two investment funds or are unsure of the current balance of your child’s trust, we recommend following up with the PGT for more information.

The BC PGT’s fees usually outpace the interest earned in our member’s trust accounts. UBCP/ACTRA is fighting to change the legislation that governs child performers’ earnings.

The legislation says “[They] provide for the waiver or remission of fees by the Public Trustee in cases of hardship or unfairness.” If upon the release of the funds, the balance of your child’s trust is less than the initial deposits, the PGT will waive the fees they charged to your child’s account.

The Public Trustee Act doesn’t explicitly require that this be done, only that they have the discretion to waive fees. The current internal policy at the BC PGT is to adjust fees enough to ensure that the closing balance is not lower than what was initially contributed.

If the PGT declines to adjust your child’s account, we recommend that you inform the union and lodge a complaint with the ombudsperson and your MLA.

Once your child turns 15, producers are no longer required to remit earnings to the PGT on their behalf. The payroll companies use your child’s date of birth to determine if trust deductions are required. You shouldn’t need to take any action to stop the deductions.

If your child turns 15 while engaged on a production, we recommend reaching out to the payroll company to confirm your child’s birthdate, so no additional remittances are made to the PGT.

In accordance with the relevant legislation, money will be held in trust by the PGT until your child reaches 19

The requirement to remit funds to the BC PGT only applies to income your child is paid while they are under age 15. Payments including use fees/residuals paid to your child after they turn 15 will not be subject to the mandatory trust deduction.

For more information, please email [email protected] or call 604-689-0727 ext. 2248